How is the P&L of Ecommerce structured and why it’s important to do it right. For fashion ecommerce managers and digital directors it is essential to know every single line of the ecommerce income statement.

The ecommerce income statement or P&L of ecommerce gives the managers a picture of the ecommerce state of health of the business, it answers some essential questions such as:

- Did we make a profit last year? Are we going to make a profit this year?

- Are revenues, costs and profits increasing or decreasing vs Last Year (LY)?

- How much is our Gross Profit Margin?

- How much are we spending in logisitcs, shipping, customer Care?

- How much are we spending in Marketing? What is the percentage of marketing spend on Net Revenue?

As you can see, the P&L of Ecommerce gives you answers to some very important questions.

The ecommerce P&L also answers questions regarding the trends of your ecommerce business, for example:

- This year our gross margin decreased by 5% vs LY

- Last year our average discount increased from 10% to 12% vs Previous Year (PY)

- Next year the cost of shipping is expected to increase from 5% to 6% on net revenue

- How to manage an ecommerce P&L and make it profitable

- The calculation of ecommerce sales (the top line)

- Reporting of returns in the ecommerce P&L

- Video podcast about P&L of Fashion Ecommerce

- The e-commerce income statement, a simple model.

- The ecommerce P&L compared with the P&L of a bricks and mortar store

- Master the Ecommerce P&L for sustainable growth

- The costs of e-commerce in the fashion industry

- Which costs should be included in the COGS in the income statement?

- The Free cash flow explain

- Capital investments in e-commerce

- Ecommerce Revenue streams or "channels"

- Cost centers

- Ecommerce P&L Example

- Differences in ecommerce P&L from company to company

- Do you want everything you need to learn to work in ecommerce?

- Mastering the P&L for sustainable growth

- E-commerce financial terminology

- 9 Steps to Make Your Ecommerce Profitable While Investing in Growth

- Now answer to 3 simple finance questions

How to manage an ecommerce P&L and make it profitable

When you manage an ecommerce website or you own a business that sells products online you need to have very clear how the P&L of Ecommerce is structured. Controlling every single line of the ecommerce P&L is essential to ensure the profitability and the growth of the ecommerce channel.

In this article we describe the essential revenue streams and cost centers that need to be accounted for and that determine the profitability of your digital ecommerce. You also find an example of ecommerce P&L the illustrates all the profit and cost items.

The calculation of ecommerce sales (the top line)

The correct calculation of ecommerce sales is the first essential step in the creation of the profit and loss statement.

Ecommerce sales are divided in:

- Gross sales at suggested retail price taxes excluded

- Gross sales net discount

- Net sales (sales discounted of the value of returns

- The gross sales at suggested retail price represent the theoretical amount of money that you would have made if you sold your products without discount. This metric is important because it allows you to calculate how much discount you are giving to your customers

- The gross sales at actual price are the money you have received from your customers excluding sales taxes and before you refund the customers for any return. This metric is important because it is considered an indication of the potential “demand” and because it impacts on the costs of logistics.

- The Net sales are the actual number that represent the revenue that you will be reporting in the ecommerce financial statement. This is the money that you make by selling the products, if you charge your customers for shipping, this revenue stream will be reported on another line of the P&L.

The calculation of e-commerce sales with the standard cost + mark-up method

If we calculate gross sales with the standard cost + mark up method, for example, we can accurately estimate sales before discounts. While if we calculate sales based just on the money received we lose information on the discount applied.

The income statement of the e-commerce channel generally looks like this:

| Gross sales = standard cost or industrial cost * mark-up | |

| Industrial cost | $50 |

| Markup | 3 |

| Sale price (Net of VAT and Sales Tax) | $150 |

| Total units sold in the period (e.g. one month) | 1,000 |

| Gross turnover | $150,000 |

| – Discounts | -$15,000 |

| Gross sales net discount | $135,000 |

| – Returns | -$35,000 |

| = Net sales | $100,000 |

NOTE: when fashion brands in Europe calculate the retail price using the mark-up formula: wholesale price * markup e.g. €100 * 2.7 = €270 the price is considered VAT included. This is mainly because the law in European countries impose retailer to show the price including taxes on the price tag. For this reason when you calculate the sales for a financial statement, that never include VAT, you need to take out the VAT component. In this example able the sales price to be reported in the financial statement, considered a VAT of 20% it would be €270/1.2 = €225

Reporting of returns in the ecommerce P&L

E-commerce returns can be reported in the financial documents in two ways:

- by the date of receipt of the return in the warehouse or

- by the date of issue of the invoice or sales receipt.

The first approach does not require estimating the quantity of returns that will be received in the period, as the returns are recorded in the accounting system after the physical receipt of the product. While with the second method it is necessary to estimate the returns that will be received after the expiry of each tax reporting period. This is called an accrual.

Let’s take an example to explain this second method of calculating returns which is the most accurate:

imagine you are managing an e-commerce of physical goods, let’s say fashion products, you are on December 1st and you decide to extend the return period for all orders received from 1st to 31st December to the end of January of the following year.

By doing so you are in effect influencing the operating result of e-commerce by artificially reducing returns for the current period by moving them to the first quarter of the following year.

My operational recommendation is therefore to calculate the average return rate of the site and apply the average return rate in the calculation of returns when closing the balance sheet of the e-commerce channel.

Video podcast about P&L of Fashion Ecommerce

Watch this video interview where Enrico Fantaguzzi explains the P&L critical factors and growth strategies for fashion brands

The e-commerce income statement, a simple model.

| Sales | |

| – Gross sales | 1,000,000 |

| – Returns | (150,000) |

| = Net sales | 850,000 |

| Costs | |

| – Cost of goods sold (COGS) | (250,000) |

| Gross Profit (often reported as gross margin as percentage) | 600,000 |

| Gross Margin | 70.5% |

| Direct costs | |

| – Human resources | (100,000) |

| – Content production (photography, descriptions, etc.) | (50,000) |

| – Technology platform | (50,000) |

| – Marketing | (100,000) |

| – Logistics | (100,000) |

| – Payments | (20,000) |

| Operating margin (EBITDA) | 180,000 |

| – Depreciation and Amortisation | (50,000) |

| Profit before tax (EBIT) | 130,000 |

The ecommerce P&L compared with the P&L of a bricks and mortar store

In the table below we compare the P&L of an online store and a bricks and mortar store for a clothing direct to consumer brand. The brand sells both via directly operated stores (DOS) and B2C ecommerce.

In the comparison table you can notice some cost items are very important for ecommerce and non relevant for the bricks and mortar stores i.e. the returns.

On the other hand you’ll notice that the bricks and mortar store have many relevant cost items that make the physical P&L difficult to break even, while the ecommerce costs are less complex.

| Sales | Ecommerce P&L | Bricks & Mortar P&L |

| – Gross sales | 1,000,000 | 1,000,000 |

| – Returns | (150,000) | ~0 |

| = Net sales | 850,000 | 1,000,000 |

| Costs of sales | ||

| – Cost of goods sold (COGS) | (250,000) | (300,000) |

| – Logistics and Shipping | (100,000) | |

| Gross Profit | 500,000 | 700,000 |

| Gross Margin | 59% | 70% |

| Direct costs | ||

| – Human resources | (100,000) | (240,000) |

| – Content production (photography, descriptions, etc.) | (50,000) | (0) |

| – Visual merchandising, windows display | (50,000) | |

| – Technology platform | (50,000) | (20,000) |

| – Marketing | (100,000) | (40,000) (3-5%) |

| – Rent | (~0) | (150,000) (15-20%) |

| – Other G&A Utilities Insurance: Property Taxes, Maintenance and Repairs | (50,000) (5%) | |

| – Payments | (20,000) | (20,000) |

| Operating margin (EBITDA) | 180,000 | |

| – Depreciation and Amortisation incl Stock Obsolescence | (50,000) | (150.000) (10-20%) |

| Profit before tax (EBIT) | 130,000 | -20,000 |

ONLINE COURSE BY DFA

Master the Ecommerce P&L for sustainable growth

Learn from leading experts and CFOs of international companies.

Fashion Finance: E-commerce P&L, Financial Planning & Cost Control

Enhance your e-commerce profitability with our Fashion Finance course. Learn financial best practices adopted by global brands, including budgeting, forecasting, cost control, and reporting. This comprehensive program equips you with the tools to master e-commerce P&L management and drive success in the online fashion industry.

The costs of e-commerce in the fashion industry

The calculation of COGS Cost of Sold in e-commerce

From an accounting point of view, the cost of goods sold is any cost directly related to the product sold, i.e. we are talking about a cost that occurs only if the product is sold.

For the correct calculation of the cost of goods sold we must take three factors into consideration:

- E-commerce buying: the assets of products that we purchase and allocate on the e-commerce warehouse with the aim of selling them over the course of one or more seasons and their degree of depreciation

- COGS are costs when we sell products and are revenues when we receive returns. This is a fact, you just need to remember to calculate them correctly.

- If the availability of goods that can be sold on the e-commerce channel is not allocated exclusively to the e-commerce warehouse but is the sum of several warehouses, the cost of goods sold cannot be calculated on the value of the e-commerce purchase or order.

Which costs should be included in the COGS in the income statement?

A possible rule is to follow the costs directly linked to the sale of the product, therefore the raw materials used and the cost of the labor used to create the product. But what do we do with credit card fees and sales commissions? These are also expenses that only occur if a product is shipped, but are generally reported lower in the e-commerce income statement.

The general practice is to report sales commission expenses lower in the income statement, because if we included all sales expenses in the cost of goods sold (COGS) we would obtain a lower gross profit and gross margin. If you are a listed company, having a significantly lower gross margin than your competition can create valuation problems.

In conclusion, the best way to determine the components of the cost of goods sold is to look at what the leading companies in the sector do in the reference market and ask for information from the auditing companies (auditors) who will be able to give sufficiently clear indications and leave the choice up to you. where to place some cost elements. Once this choice has been made, it is best to maintain it for several accounting periods to have the possibility of making year-on-year comparisons and determining trends.

For further information: Steve Bragg podcast episode 323 the cost of goods sold

What we didn’t consider

Fixed costs and variable costs –> projection

KPIs such as average discount rate

VAT and taxes

Indirect costs: business costs such as offices, accounting, general management

The Free cash flow explain

The free cash flow is essential to survival of fashion brands as it represents the ability to pay current costs and debts.

How is free cash flow calculated? Let’s see a simple example. Let’s suppose we sell 1 luxury bag at 1.000 USD

| Free cash Flow | ||

| Bag sale | 1.000 | cash in |

| Suppliers COGS | 200 | cash out |

| Transport | 50 | cash out |

| Personnel cost | 50 | cash out |

| Rent | 300 | cash out |

| Taxes | 100 | cash out |

| +300 | Free cash flow |

Capital investments in e-commerce

Capital investments are often considered less important than operating costs, but that’s not how it works in e-commerce.

Analysts often look at the EBITDA i.e. they stop at the level of operating costs to determine the sustainability of the income statement of the e-commerce channel. This means that investments in infrastructure are overlooked, for example the creation of the e-commerce platform, are considered below EBITDA and therefore only fall within the calculation of EBIT otherwise known as profit before taxes and interest on capital.

In e-commerce, unlike physical bricks and mortar channels, investments in infrastructure are continuous because technology continually evolves, therefore you need to look at the EBIT to really understand the financial sustainability of an ecommerce.

Ecommerce Revenue streams or “channels”

Direct to Consumer (DTC) E-commmerce

DTC ecommerce is your brand website, usually it’s a brand.com website or localised e.g. brand.co.uk. This is your main domain on which is installed an ecommerce platform

Digital Wholesale Ecommerce

The relationship with e-tailers such as Net-A-Porter or Yoox. When you sell at wholsale price and in bulk to retailers or etailers that resell your products

Marketplaces P&L

Fashion Online Marketplaces are ecommerce websites that features a multitude of brands and products. The marketplace doesn’t own the products that are on sale, it may stock the products or sell them in drop-shipping. Fashion brands sell on marketplaces for different reasons and goals e.g. to increase online sales and reach new customers in different markets.

Examples are Farfetch, Zalando, Miinto, but also many retailers and etailers have implemented the marketplace model on their website. This means that some websites are both etailers and marketplaces e.g. Breuninger, Galeries Lafayette, Yoox. Also brands can convert their websites into a markerplace allowing third party selllers to sell on your website. Read more about fashion online markeplaces management.

When planning the business strategy for selling on marketplaces you need to create a profit and loss statement for the marketplaces. The difference between the P&L of the DTC ecommerce and the Marketplaces P&L is mainly related to the commission fee that you’ll need to pay to the marketplace.

In the table below we see an example of how the profit and loss of ecommerce can be different from Direct to Consumer to Marketplaces

| Sales | DTC | Marketplaces |

| – Gross sales | 1,000,000 | 1,000,000 |

| – Returns | 150,000 | 150,000 |

| = Net sales | 850,000 | 850,000 |

| Costs | ||

| – Cost of goods sold (COGS) | 250,000 | 250,000 |

| Gross Profit | 600,000 | 600,000 |

| Gross Margin | 70.5% | 70.5% |

| Direct costs | ||

| – Human resources | 100,000 | 50,000 |

| – Content production (photography, descriptions, etc.) | 50,000 | 10,000 |

| – Technology platform | 50,000 | 10,000 |

| – Marketing | 100,000 | 80,000 |

| – Logistics | 100,000 | 100,000 |

| – Payments | 20,000 | 0 |

| – Marketplaces commission (20% on net sales) | 0 | 170,000 |

| Total operating cost | 670,000 | 670,000 |

| Operating margin (EBITDA) | 180,000 | 180,000 |

| – Depreciation and Amortization | 50,000 | 50,000 |

| Profit before tax (EBIT) | 130,000 | 130,000 |

Digital in store

With the integration of online and offline channels, also called omnichannel, you can sell digitally from you phisycal store. You can use story telling apps on mobile phones, in this case there is an interaction with the sales personnel of the store, or you can install kiosks in store where the customers can order digitally from the store.

Flash Sales

Flash sales are events online with a duration of a few days when the customers can buy with a high discount. These websites are for example Veepee or Privalia or Best Secrets. It’s a good solution for brands who need to sell out remaining stock from the past season that is still in good conditions to be sold but it’s not suitable for the official stores.

Cost centers

Digital Supply Chain

The digital supply chain is the activitiy that consist in the creation of the photos, videos, descriptions, translations of the products.

Logistics

The logistics is typically the wharehouse where you stock your merchandise, it can be directly operated by the brand or a service that you rent, in this case is a Third Party Logistics 3PL.

Cost of Technology

Ecommerce needs serval technological applications that need to be integrated to manage all the data flows: products, stock, prices, orders, customer data.

Cost of Goods

Cost of Goods Sold is the first “cost item” that you find in the ecommerce P&L, the Net Revenues – the costo of goods sold determines the Gross Profit. Gross Profit / Net Revenue = Gross Margin which is an essential KPI for the profitability of fashion brands.

Legal and Administration

The costs that are not specifically generated by ecommerce such as the cost of top management, finance and administration and HR are spread over the profit centers in a proportional manner. For example the cost of Administration is divided by Retail, Wholesale and Ecommerce department proportionally to the revenue generated by each sales channel

Cost of Personnel

Ecommerce teams are made of few or hundreds of headcounts depending on the size of the business. Typically you have an Ecommerce Manager or Director and you have a Store Manager, a Buyer, a Visual Merchandiser, a Graphic Designer, an Operations Manager to oversee Logistics, Customer Service and Operation, you may have an IT person within your ecommerce team and one or more Customer Service operators.

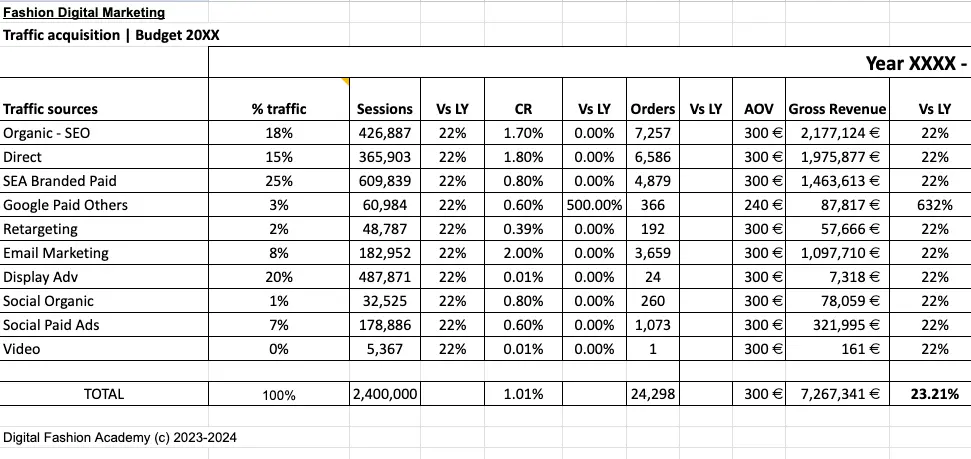

Digital Marketing Budget with P&L

Digital Marketing is one of the essential investments that need to be made to sell online, the investment in Digital Marketing is essential to generate traffic. While in bricks and mortar stores the traffic is generated by the location, online you need to invest in digital marketing to create traffic. You can invest in paid traffic for example advertising or you can create content the organically attracts visitors, this is also called content marketing.

Marketing P&L example

The Marketing management team is responsible for driving traffic to the ecommerce website, that converts in orders, at a reasonable cost.

It’s not sufficient for the marketing team to generate visits on the website, because these visits or visitors may not be interested in the products we sell and therefore they will not buy i.e. they won’t convert.

It is well know if you work in the ecommerce industry that different marketing channels have different conversion rates. Therefore when you are working on creating your digital marketing budget, it’s best practice to break down the traffic by media channel as shown in the example below.

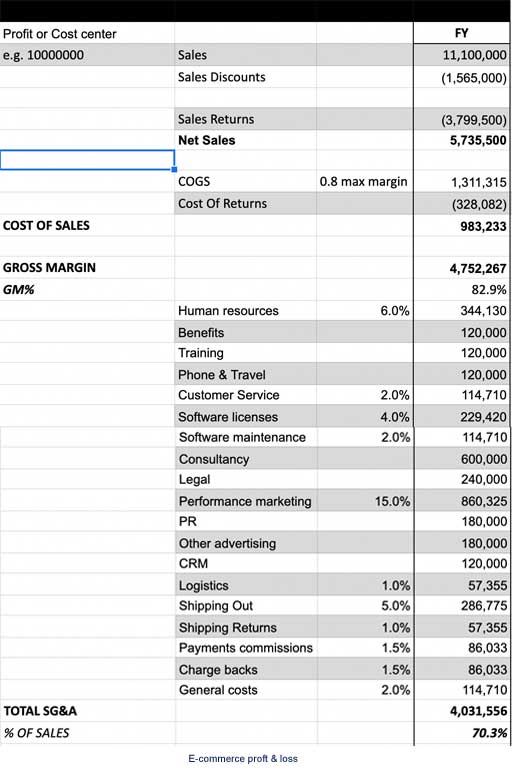

Ecommerce P&L Example

This is an example of a full profit & loss statement for an ecommerce that sells fashion products. You can notice the profit and cost centre structure on the left. In the first 4 lines of the P&L you have the P&L Items that determine the Net revenue or Net Sales: Gross Sales (Sales) – Discounts (Sales Discounts) – Returns in Value (Sales Returns).

Differences in ecommerce P&L from company to company

It is important to understand that there is no single way for writing an ecommerce P&L, as it depends on the financial standards that we follow. Even at an accounting level there are different standards that companies can use and, depending on the standard used, the formatting of the income statement of the e-channel commerce or other channel may be different.

The important thing is to maintain consistency on how we calculate the revenue and cost items in the ecommerce P&L from one year to another, this allows to highlight trends in performance indicators over time that are consistent with each other. For example, if we calculate the cost of goods sold in one way in one year, we must calculate it in the same way the following year to be able to compare it. Here some more examples:

- This year our gross margin decreased by 5%

- This year our averaged discount increased from 10% to 12%

- This year the cost of shipping went up from 5% to 6% on net revenue

Ref. https://www.accountingtools.com/articles/2017/5/5/purchase-price-variance

Do you want everything you need to learn to work in ecommerce?

Enrol into our online course.

Ecommerce Profit Playbook

Mastering the P&L for sustainable growth

Start improving the financial performance of your ecommerce by learning the financial best practices, cost control strategies and KPIs

E-commerce financial terminology

- Gross sales or gross revenue: These are sales before returns, other deductions and without Value Added Tax (VAT) or Sales Taxes.

- Net Sales: Gross Sales minus Deductions (like Discounts) and ECommerce Returns

- Net revenue = Net sales + Additional ecommerce revenue e.g. shipping costs paid by customers.

- Top-line: revenues or sales

- Operating profit: Earnings Before Interests and Taxes (EBIT)

- Bottom line: Net profit

- COGS: Cost of Goods Sold

- Standard cost: it is a way of calculating the cost of goods sold based on the cost of the product components: cost of the material used + cost of processing = cost of the product.

- Depreciation of warehouse products: each product tends to lose value if it is not sold and remains in warehouse for a long time. For this reason, conventions and practices are defined for the devaluation of warehouse products. These values are entered as costs in the income statement of the ecommerce channel.

- Tracking e-commerce sales: gross sales vs. net sales

- Very often sales in e-commerce are called with the English term Sales or Revenue to which the prefixes Gross and Net are added.

Never miss an update

Sign up to our mailing list and receive updates on training programs, job opportunities and free resources.

9 Steps to Make Your Ecommerce Profitable While Investing in Growth

It’s a common justification (or rather, an excuse) to claim that your ecommerce isn’t profitable due to various investments—whether in marketing, advertising, or new ecommerce platforms. The reality is that these investments are here to stay: you’ll continuously need bigger budgets to cover rising advertising costs, and every few years, you’ll have to upgrade your technological infrastructure.

So, how do you achieve a profitable ecommerce business?

- Create a Roadmap: Design a comprehensive roadmap that outlines improvements from both business and technological perspectives. This roadmap could include technical enhancements, user experience upgrades like new ecommerce features or payment methods, and business expansion plans, such as entering new markets. Plan your roadmap over a 3 to 5-year period, assign target uplifts for each improvement, and stick to the plan (as much as possible).

- Early Budgeting Process: Start your budgeting process for the following year early, ideally between July and September. Involve the entire team using a bottom-up approach. Ask team members responsible for different areas to provide estimates of costs and expected performance for the coming year. This collaborative approach will help you fine-tune the budget and adjust your roadmap accordingly.

- Set Realistic Sales Targets: When estimating your sales, base your projections on past trends and realistic growth in website traffic. Don’t rely on simply buying traffic, as paid traffic often has lower conversion rates. This ties into the next point.

- Define Your Digital Marketing Budget: For each media channel (e.g., organic search, paid search ads, organic social, paid social), estimate the number of visits or sessions you expect to generate. Assign specific conversion rates and average order values to each acquisition channel.

- Target Sales for Each Initiative: Assign sales targets to each initiative you plan to execute throughout the year, whether it’s launching a virtual fitting room, expanding to a new market, or improving website loading speed. Estimate the expected uplift from each activity. The same goes for commercial activities: how many days of Black Friday will you run? Are you launching a new loyalty program?

- Evaluate Promotional Activities Carefully: For each promotional effort, consider three factors: the uplift in sales, the reduction in gross margin due to discounts, and the likely increase in returns. Remember that new customer acquisition often leads to a higher return rate.

- Control Costs: If you’re forecasting growth in sales volume, renegotiate contracts with suppliers to reduce costs—whether it’s shipping, customer service, or platform commissions. Aim for supplier deals with fixed costs so that as your business grows, your margins increase.

- Collaborate with Your Finance Team: Your financial team—administration, CFO, or controllers—are invaluable allies in maintaining financial control. Leverage their expertise to implement best practices that will help you grow both your top and bottom lines.

- Accurately Allocate Ecommerce Costs: Ensure that all costs associated with digital marketing are correctly classified in your ecommerce P&L. Misclassifications can skew your profitability analysis.

Want to Master Your Ecommerce P&L for Success?

Discover our on-demand course: Fashion Finance: Mastering Ecommerce P&L for Sustainable Growth.

DM us for info or comment “interested” below!